What can you get for less than ₹1? Take a moment to guess… Nothing?

Well, think again! Indian Railways offers travel insurance for just 49 paise! 🚆💼

What is IRCTC Travel Insurance?

IRCTC provides optional travel insurance for train passengers at a nominal charge of just 49 paise per person. This insurance offers coverage of up to ₹10 lakh in case of an unfortunate accident.

🔹 Premium: 49 paise per passenger

🔹 Coverage: Up to ₹10 lakh

🔹 Optional: You can choose to opt-in or skip it while booking tickets

Why Should You Take It?

For just a few paise, you get financial protection in case of accidents while traveling. Given the huge benefits at such a minimal cost, it’s highly recommended for all train passengers.

Who Provides the Insurance?

IRCTC has partnered with leading insurance companies like:

✅ ICICI Lombard

✅ Shriram General Insurance

✅ Others

How to Get IRCTC Travel Insurance?

1️⃣ While booking your train ticket on the IRCTC website, check the box for Travel Insurance.

2️⃣ After booking, you will receive an email confirmation regarding your insurance.

3️⃣ Some insurance providers send the insurance policy as an attachment, while others ask you to fill out a nomination form.

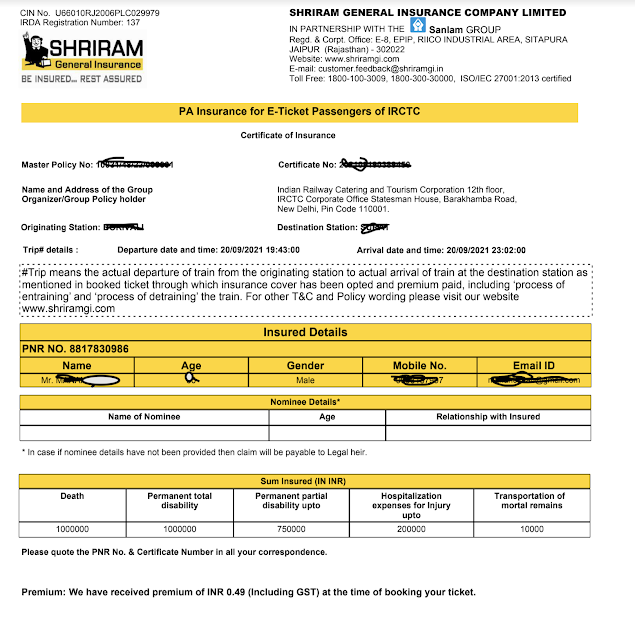

Example of My Travel Insurance

I personally opted for IRCTC Travel Insurance through Shriram General Insurance, and the process was simple and hassle-free. This small step ensures peace of mind during your journey.

IRCTC offers an incredible travel insurance policy for train passengers at a minimal cost of just 49 paise. Let’s take a look at the benefits it provides:

IRCTC Travel Insurance Coverage

| Incident | Coverage Amount |

|---|---|

| Death | ₹10 lakh |

| Permanent Total Disability (Full body disability) | ₹10 lakh |

| Permanent Partial Disability (Partial body disability) | Up to ₹7.5 lakh |

| Hospitalization Expenses | ₹2 lakh |

| Mortal Remains Transportation (In Case of Death) | ₹10,000 |

For just up to 50 paise, you get coverage worth ₹10 lakh. Isn’t that an amazing deal? Would you take it? Of course, you should!

How to Opt for IRCTC Travel Insurance Online?

Follow these simple steps to get travel insurance while booking your train ticket on the IRCTC website:

Step-by-Step Process

1️⃣ Login to IRCTC and enter your Source, Destination, and Date to search for trains.

2️⃣ Select your preferred train and class (Sleeper, Seating, 3 AC, etc.).

3️⃣ Fill in passenger details and other required information.

4️⃣ Look for the "Travel Insurance" option during booking—it is optional but highly recommended!

5️⃣ Check the box to opt for travel insurance.

6️⃣ Complete the payment and confirm your ticket.

7️⃣ After booking, you will receive an email with insurance details from the provider.

When booking your train ticket, you can easily opt for IRCTC travel insurance by selecting the right option. Here’s how you can do it:

Step-by-Step Guide to Selecting IRCTC Travel Insurance

1️⃣ Select "Yes" for Travel Insurance during ticket booking.

2️⃣ Accept the Terms & Conditions (You can read the full terms online).

3️⃣ The insurance cost (₹0.49 per passenger) will be added to your final booking amount.

4️⃣ Complete the booking and make the payment.

What Happens After Booking?

✅ You will receive a ticket confirmation email from IRCTC.

✅ You will also receive an email from the insurance provider.

✅ Some insurance companies send the policy document as an attachment, while others require you to fill out a nomination form.

For example, I received my travel insurance confirmation email from Shriram General Insurance after booking my ticket through IRCTC.

What Happens in Case of an Accident?

If an unfortunate train accident occurs, passengers or their families will receive financial benefits as per the travel insurance policy.

🔹 No Cancellations Allowed: Once the premium is paid, IRCTC does not allow cancellations or refunds, even for waitlisted tickets.

🔹 Nominee Details: If the nomination form is not filled, the settlement will be made with legal heirs in case of a claim.

🔹 Children Under 5 Years: IRCTC travel insurance does not apply to children below 5 years of age.

🔹 Uniform Coverage: This insurance applies to all classes (Sleeper, AC, etc.).

Key Terms & Conditions (Simplified)

✔ Policy Information via SMS & Email – Passengers will receive details via email and SMS, along with a link to fill in nominee details.

✔ Claim Settlement – If nominee details are not provided, the claim will be settled with legal heirs.

✔ Comprehensive Coverage – Insurance covers death, permanent disability, partial disability, hospitalization expenses, and mortal remains transportation.

✔ Coverage Even for Short-Termination & Diversion – If a train is diverted or short-terminated, the policy remains valid, including alternate travel arrangements made by Railways.

✔ Vikalp Train Validity – If the passenger is shifted to a Vikalp train, the insurance policy remains valid.

✔ Hospitalization Benefits – The hospitalization expenses covered are in addition to disability/death compensation.

For just 49 paise, IRCTC travel insurance offers huge benefits and financial security during train journeys. Always remember to fill in nominee details after booking to ensure a smooth claim process.

No comments:

Post a Comment